Tax laws seem to be constantly changing and their impact on us can sometimes remain unclear. In this webinar, we take a current look at taxes and how they impact you, your retirement, and your estate.

Category: Article

Clearly, there is a lot to think about when planning for retirement. While we have a degree of control over many of the choices involved, there’s one big wild card called sequence of return risk.

Sequence of return risk is the risk that you’ll encounter negative investment returns in early retirement. This is an important consideration, because the sequence – or order – in which you earn your returns early in retirement can have a significant impact on your lasting wealth. Simply put, a retirement portfolio that happens to experience positive returns early in retirement will outlast an identical portfolio that must endure negative returns early in retirement. This is true even if the long-term rate of return for both portfolios are identical.

Since nobody can predict which return sequence they’ll experience early in their retirement, every family should prepare for a range of possibilities in their retirement planning.

The Significance of Sequence of Return Risk

It’s no secret that global stock markets are volatile. While long-term average annual returns may be in the range of 7% for a diversified portfolio of global stocks and bonds, markets rarely deliver average returns in any given year. Rising one year, falling the next; we never know for sure how far above or below the average each year will be.

During your career, you’re mostly spending earned income, while adding to your retirement portfolio. As long as you stay the course benefiting from the upswings and enduring the downturns – tolerating market volatility is just part of the plan.

In fact, when you’re still accumulating wealth, market downturns give you the opportunity to buy more shares than you otherwise could when prices are higher. When the market recovers, you then have more shares to recover with, which ultimately strengthens your portfolio.

But then, you stop working, and start spending your reserves. This has the opposite effect. Now, when the stock markets decline, you may need to make a withdrawal from a portfolio that has declined in value. This underscores the need for a broadly diversified asset allocation of stocks and bonds. When stocks are down, we want to source withdrawals from the part of the portfolio that has maintained its value. Selling an asset when it is down, means you will have fewer shares with which to participate in the eventual recovery. This hurts your portfolio’s staying power.

Sequence of return risk Illustrated

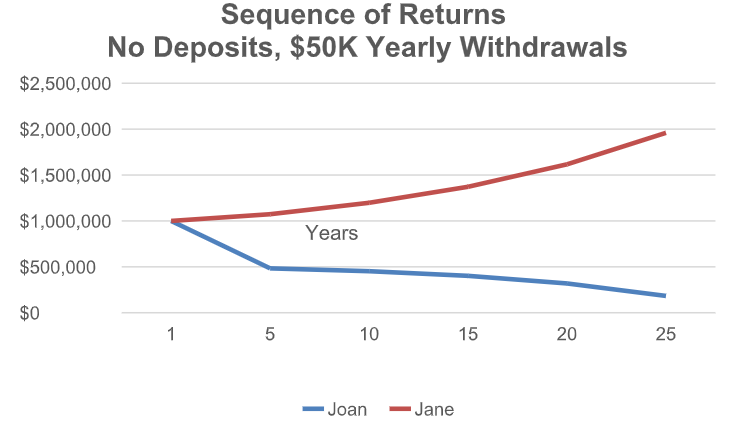

Consider two hypothetical retirees, Joan and Jane:

- Both retire at age 65 with identical $1 million dollar stock portfolios.

- Both start withdrawing $50,000 annually at the start of each year (not adjusted for inflation).

- Both earn the same 7% average annual returns over their 25 years in retirement.

With so much in common, you might assume their portfolios would perform similarly. But what if Joan happens to enter into retirement during a horrible market? Let’s imagine her portfolio returns –30% and –20% in her first two years, while Jane earns 7% both years, and (implausibly) every year thereafter.

Markets recover nicely for Joan after two years so, again, she ultimately earns the same average 7% annual return as Jane. But Sequence of return risk takes a heavy toll on Joan’s remaining shares. She ends up with only about $150,000, while Jane’s portfolio grows nicely to around $2 million.

Portfolio is hypothetical and exaggerated to demonstrate impact of volatility.

Source: Wendy J. Cook Communication, LLC

Managing the Sequence of return risk Wild Card

Sequence of return risk should NOT change your overall approach to investing. As the recent past has clearly shown us, you never know what’s going to happen next. Stock market corrections typically occur

without warning, while some of the strongest rebounds arrive amidst the darkest days.

So, whether you’re 40, 60, or 92, we still recommend building and maintaining a low-cost, globally diversified portfolio that reflects your personal goals and risk tolerances. We still advise against trying to pick individual stocks or react to current market conditions. We still suggest you only change your portfolio’s asset allocations based on life events, not market events.

What can you do to mitigate Sequence of return risk if it happens to you?

Keep working. If you are willing and able, you might postpone retirement, or even return to the workforce. Even part-time employment can help offset an ill-timed sequence of negative market returns.

Spend less. Since your portfolio is most vulnerable to negative sequence of return risks early in retirement, you may want to initially spend less than planned, to give your portfolio an opportunity to rebound.

Tap other assets. When you retire, you typically have several sources of income to draw from. You may have emergency cash reserves, Social Security, or pension plans. Your investments are usually divided

between stocks and bonds. You may have equity in your home. If you encounter a negative stock market in retirement, you might be able to tap a combination of your non-stock assets for initial spending needs.

Consult with a financial advisor. Sequence of return risk is usually not the only consideration at play in retirement planning. There are taxes to consider and estate planning goals to bear in mind. There are carefully structured investment portfolios to maintain. All these needs speak to the value an experienced advisor can add before, during, and after this pivotal time in your financial journey.

At Conrad Siegel, we help our clients prepare for and mitigate Sequence of Return Risk within the greater context of their goals for funding, managing, spending, and bequeathing their lifetime wealth. Please be in touch today if we can help you with the same.

Our team welcomed Conrad Siegel’s Chief Investment Officer, David Lytle, FSA, CFA, MAAA for a virtual event. Together, we took a look back at the market and the events of the last 12 months. We also looked ahead, breaking down key data points that we can use as a guide for investing in the year ahead.

Conrad Siegel’s Tracy Burke, CFP®, ChFC® and Catherine Azeles, CFP®, RICP® share an overview of the investment world. This short video takes a look at what happened in the markets during the last quarter, what we can expect moving forward, and what it all means for you.

Estate Planning is something that we talk about often when discussing your finances and overall plan. There is no denying that this topic is a big one. There are so many parts to it and just when you think you know it all, the laws change. That’s why we brought in an expert, Certified Estate and Elder Law Attorney, Jeffrey Bellomo, for this virtual event to discuss ways to avoid the pitfalls by doing the appropriate Estate Planning.

Now more than ever, so many aspects of our lives are taking place online. Conrad Siegel and guest speaker Jerry Mitchell, Education and Outreach Specialist with the Pennsylvania Office of Attorney General discuss important steps you can take to protect your identity and personal information.

Many of the investment mistakes we see people make are rooted in our behavior as investors. Conrad Siegel’s Catherine Azeles, CFP®, RICP® discusses some of the most common investment mistakes we see today and ways that we can avoid them.

To many, the beginning of fall is marked by the change in foliage, the return of football season, and the arrival of cooler weather. But to a select few, the beginning of the annual Medicare enrollment process is lurking among the pumpkins. This fall we’re inviting you to enjoy more treats (reminders and considerations) and less tricks (stress and uncertainty) with respect to Medicare plans, costs, and the open enrollment process more generally.

Mark Your Calendar: Open Enrollment Period

October 15th – December 7th (Annual open enrollment for Medicare’s medical and prescription drug plans)

Leading up to this period, you may receive important notices from Medicare or Social Security alerting you of any changes to your current health plan, as well as information on how to find plans in your area. During the open enrollment time period, you can make the following election changes:

- Move from a Traditional Medicare plan to a Medicare Advantage plan

- Move from a Medicare Advantage plan back to a Traditional Medicare plan (and possibly a Medigap plan)

- Change from one Medicare Advantage plan to another Medicare Advantage plan

- Change Medicare prescription drug plans

If you decide to make a change during this open enrollment period, your new plan enrollment will be effective on the following January 1st.

What about Medigap?

It’s worth noting that you may not be able to change Medigap plans during the October 15 – December 7 open enrollment period since the only guaranteed-issue rights with respect to enrollment in a Medigap plan apply during an individual’s initial Medicare enrollment period. If you have one Medigap plan and want to move to another one, you may have to wait for a special enrollment period to apply.

January 1st – March 31st (Additional special enrollment period just for Medicare Advantage plans)

During this time, individuals enrolled in a Medicare Advantage plan may change to another Medicare Advantage plan or move back to Traditional Medicare.

Which Plan Do I Pick?

Whether it’s your initial enrollment in Medicare or your annual open enrollment, it’s a good practice to review the health plans that are available to you and decide which option best fits your needs for the coming year. The good news is learning the basics of available Medicare options is something you can even do prior to open enrollment.

Individuals enrolling in Medicare benefits essentially have two main coverage options, with a number of considerations regarding which of these options may work best for you, including:

- Costs

- Current medical conditions

- The providers you regularly see

- Where you expect to travel or live during the coming year

The two Medicare main coverage options are:

- Traditional Medicare (Typically more broadly accepted by providers)

- Comprised of Medicare Parts A and B

- Possibly paired with:

- Medicare Part D plan (prescription drug coverage) and

- A “Medigap” or “Medicare Supplement” plan which is designed to help cover some of the traditional out-of-pocket costs that apply under Medicare, including the Part A deductible and Part B coinsurance.

- A Medicare Advantage Plan (Structured more like a PPO or HMO that you may have had through an employer plan while actively working)

- Also known as a Medicare Part C plan

- May or may not be paired with prescription drug coverage

- Could have a lower premium cost vs. Traditional Medicare & Medigap options

- May cover additional benefits like hearing or vision, but may also:

- Restrict your choice of providers (through a network that may be subject to local providers)

- Feature cost containment measures (like prior authorizations or referral requirements)

One you decide which arrangement works best for you, you still have the choice of deciding which specific Medicare Advantage, Medigap, and/or prescription drug plan you want. Typically, your choice will be between plans with lower monthly premiums that feature higher out-of -pocket costs when services are provided and plans with higher monthly premiums and lower out-of-pocket costs for services. When you choose your plan for the coming year, it’s recommended you consider the total premium, the potential medical and prescription drug services you may incur in the coming year, and whether your current medical providers participate in your desired plan’s network (if applicable).

Additional Resources

Whether Part A, B and C sound more like complicated furniture assembly directions or you feel comfortable with your options, Medicare resources are available at both the federal and state level to help you evaluate your options and navigate the enrollment process.

The Centers for Medicare & Medicaid Services (CMS) (https://www.cms.gov/) have a number of online resources for individuals, in addition to creating an annual “Medicare & You” handbook that is sent to Medicare households each year in late September. This handbook provides the high-level basics on Medicare options, enrollment periods, and information on how an individual becomes enrolled in Medicare. The guide also has detailed and up-to-date information on all the services that are covered by Medicare. (For instance, acupuncture became an allowed service in early 2020!)

In Pennsylvania, the Department of Aging features a robust Medicare website with access to free counselors who are available to help answer questions and provide objective information to health plans available to you. These counselors can be a valuable complimentary resource to help you:

- Understand the current Medicare plan you have in place

- Learn how your current plan compares different options available to you

- If you need assistance in processing a Medicare appeal.

If you are not a Pennsylvania resident, check your home state’s online resources to see what tools may be available to you.

As open enrollment season approaches, remember that a more informed choice on your Medicare coverage can help you manage healthcare costs and potentially bring a little more peace of mind with respect to your health as you begin a new year.

Conrad Siegel’s Tracy Burke, CFP®, ChFC® and Catherine Azeles, CFP®, RICP® share an overview of what’s happening in the investment world. This short video reviews what’s currently driving the markets, what we can expect moving forward, and what it all means for you.

Conrad Siegel’s Brooke Petersen, CFP®, ChFC® shares a brief overview of the tax proposals the Biden Administration had on the table as of late May 2021. More recent developments point to corporate tax increases being unlikely at this time. What we do know is discussions and negotiations are ongoing. As potential tax changes unfold, we will continue to explore what they may mean for investors.