Inflation and You – How it Impacts Investors

There is a lot of talk about inflation these days. Indeed, there are many economists and policymakers who are on national TV or writing articles online about how they are forecasting higher inflation through the rest of the year. They argue that with interest rates being so low, so much Federal stimulus money flowing through the economy, and the economy emerging from a pandemic, prices will rise faster than many people expect. However, let’s take a step back and review what exactly inflation is, how it affects the economy, and what can be done about it.

Inflation is the general rise in prices in an economy. Its presence typically means that an economy is growing, especially when inflation is accompanied by rising wage growth. The 2% rise in milk prices when you go to the grocery store won’t matter as much to you if your wages have kept up. Supply and demand for goods and services are in relatively good equilibrium. An increase in inflation doesn’t mean that prices for all goods and services are rising in unison, just that a “basket” of these have shown price increases overall.

It makes sense then that the amount and rate of change of inflation matters. When inflation is low and stable, wages have an easier time keeping up, and consumers can make adjustments to their budgets relatively easily to combat rising prices. The FED has come out in the last year saying that they are targeting an “average” of 2% inflation, meaning that continued they are okay if inflation runs higher for a time, just so the average is about 2%. This rate of inflation, in their eyes, means that the economy is in equilibrium, with prices rising just enough so that the economy can grow at a sustainable rate. However, this has been quite the difficult task over the last ten years:

As mentioned, rising inflation numbers are typically synonymous with a growing economy (if it’s not, it’s called stagflation, where there is inflation but no growth in the economy), and therefore are also synonymous with rising interest rates, mostly in the long-term end of the curve. When inflation expectations rise, longer-term yields typically rise along with them. This can play havoc in the bond market. Rising rates and inflation mean that the purchasing power of each coupon (interest) payment an investor receives has declined.

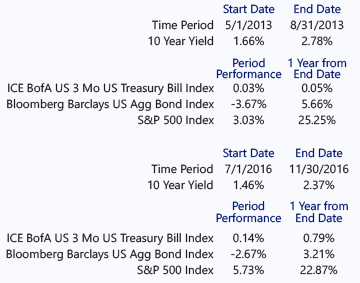

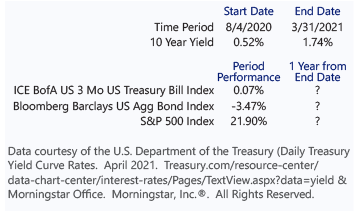

In addition, those with longer duration bonds in their portfolios will see larger price declines as rates rise. This is typically a short-term phenomenon though. Looking back over the last ten years, there have been two times when rates rose dramatically over a short period. Both times, the Barclays U.S. Aggregate Bond Index, a benchmark that tracks intermediate-term bonds, bounced back in the year after the dramatic rise ended:

This time around, the 10 year yield bottomed on August 4, 2020. Since then, the Barclays U.S. Aggregate Bond Index is down 3.47%.

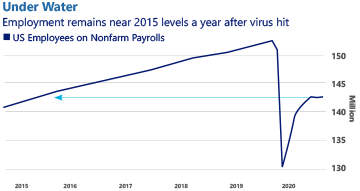

With both inflation and inflation expectations rising, then, why is the FED sticking to the original script and forecasting no rate increases until 2023? The FED has a dual mandate of price stability and maximum sustainable employment. As mentioned, they came out last year with an updated inflation goal of an “average” of 2%. This means that they will allow inflation to run hot (over 2%) for a time before considering raising their benchmark rate. While current inflation is approaching this 2% target, they still are not worried. Why? There is still considerable slack in the jobs market despite the unemployment rate falling by over half since the pandemic started: The economy has yet to regain over 9 million jobs lost from the pandemic.

The FED sees this and thinks that with this much slack in the jobs market, price pressures due from rising demand may be transitory due to short-term stimulus from the Government. Inflation can be a good thing, especially when it’s not volatile and it’s expected. However, when inflation runs too high, or when there are unexpected shocks, that can cause mayhem in markets. The FED’s job is to manage this inflation risk, taking into account many different factors, hopefully smoothing out any volatility that could arise.

There is certainly some pain being felt in portions of the markets with rates rising. We have already seen bond funds posting negative returns due to the increase in rates and the low starting point. However, it is also not desirable for investors to earn close to a 1% nominal yield on their bonds in the long-run. Certain parts of the equity markets that increased dramatically on the backdrop of low interest rates have already started to see a pull back with rates moving north. However, this could be viewed as a healthy correction and other parts of the markets that did not have the same large rally in 2020 are showing some stronger performance. We don’t yet know the length and magnitude of this current rising rate environment, and inflation certainly can be problematic. However, it is important to know that higher rates and inflation expectations can be a good thing, especially when accompanied by strong economic growth, which is what we are seeing now as we emerge from this pandemic. A historic recession and unprecedented fiscal/monetary response is likely to result in a recovery that has its stressful and uncertain moments. But as always, we believe it is important to keep focused on a strategy that matches your time

horizon.