Is now a good time to invest?

This is a question we often hear people ask – is now a good time to invest? Sometimes it is asked after the market has had a good run and is sitting at an all-time high. Other times it comes up when the market has been through a significant downturn.

So, what’s the answer? If you are truly a long-term investor, it’s always a good time to invest. Should the market be higher in 10 years from now? Yes. What about 20 years from now? Absolutely. Let’s look at some data points that should be meaningful in understanding if now is a good time to invest.

When the stock market hits an all-time high, the media loves to talk about it and investors often feel like they will not have strong gains moving forward. However, the data says otherwise. The historical data indicates that over 1, 3 and 5 year periods after the market hits an all time high, the average subsequent performance is actually quite good. These are annualized (i.e. – average annual) returns and are quite strong.

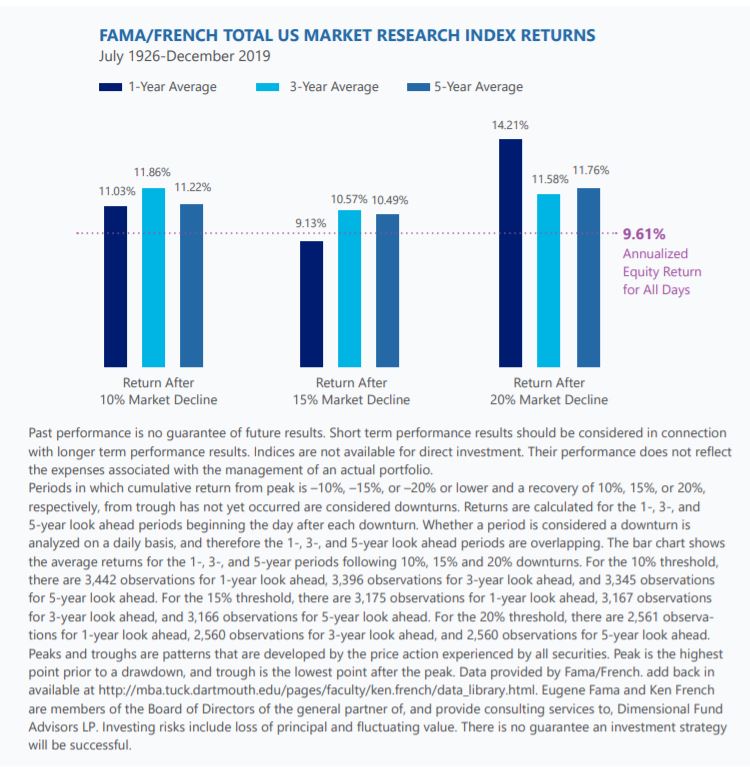

Let’s also look at the average performance of the stock market after the market endures losses of 10, 15 or 20%. This study shows that US stocks have generally delivered strong returns over the following 1, 3 and 5 year time periods following a steep decline. In nearly all cases, the subsequent performance is above the long-term average annual return of equities.

So what have we learned? If currently invested, sticking with your plan helps put you in the best position to capture the recovery. If sitting in cash and waiting for the best time to invest, often we end up waiting well past the optimal point in an effort to capture perfect timing. Data suggests it’s impossible to time the market, so investing either via a lump-sum or gradual dollar cost averaging approach is often the most prudent strategy when investing a cash position.