Author: Alyssa Goodling

Conrad Siegel’s Tracy Burke, CFP®, ChFC® and Catherine Azeles, CFP®, RICP® share an overview of the investment world. This short video takes a look at what happened in the markets during the last quarter, what we can expect moving forward, and what it all means for you.

Estate Planning is something that we talk about often when discussing your finances and overall plan. There is no denying that this topic is a big one. There are so many parts to it and just when you think you know it all, the laws change. That’s why we brought in an expert, Certified Estate and Elder Law Attorney, Jeffrey Bellomo, for this virtual event to discuss ways to avoid the pitfalls by doing the appropriate Estate Planning.

Now more than ever, so many aspects of our lives are taking place online. Conrad Siegel and guest speaker Jerry Mitchell, Education and Outreach Specialist with the Pennsylvania Office of Attorney General discuss important steps you can take to protect your identity and personal information.

Many of the investment mistakes we see people make are rooted in our behavior as investors. Conrad Siegel’s Catherine Azeles, CFP®, RICP® discusses some of the most common investment mistakes we see today and ways that we can avoid them.

To many, the beginning of fall is marked by the change in foliage, the return of football season, and the arrival of cooler weather. But to a select few, the beginning of the annual Medicare enrollment process is lurking among the pumpkins. This fall we’re inviting you to enjoy more treats (reminders and considerations) and less tricks (stress and uncertainty) with respect to Medicare plans, costs, and the open enrollment process more generally.

Mark Your Calendar: Open Enrollment Period

October 15th – December 7th (Annual open enrollment for Medicare’s medical and prescription drug plans)

Leading up to this period, you may receive important notices from Medicare or Social Security alerting you of any changes to your current health plan, as well as information on how to find plans in your area. During the open enrollment time period, you can make the following election changes:

- Move from a Traditional Medicare plan to a Medicare Advantage plan

- Move from a Medicare Advantage plan back to a Traditional Medicare plan (and possibly a Medigap plan)

- Change from one Medicare Advantage plan to another Medicare Advantage plan

- Change Medicare prescription drug plans

If you decide to make a change during this open enrollment period, your new plan enrollment will be effective on the following January 1st.

What about Medigap?

It’s worth noting that you may not be able to change Medigap plans during the October 15 – December 7 open enrollment period since the only guaranteed-issue rights with respect to enrollment in a Medigap plan apply during an individual’s initial Medicare enrollment period. If you have one Medigap plan and want to move to another one, you may have to wait for a special enrollment period to apply.

January 1st – March 31st (Additional special enrollment period just for Medicare Advantage plans)

During this time, individuals enrolled in a Medicare Advantage plan may change to another Medicare Advantage plan or move back to Traditional Medicare.

Which Plan Do I Pick?

Whether it’s your initial enrollment in Medicare or your annual open enrollment, it’s a good practice to review the health plans that are available to you and decide which option best fits your needs for the coming year. The good news is learning the basics of available Medicare options is something you can even do prior to open enrollment.

Individuals enrolling in Medicare benefits essentially have two main coverage options, with a number of considerations regarding which of these options may work best for you, including:

- Costs

- Current medical conditions

- The providers you regularly see

- Where you expect to travel or live during the coming year

The two Medicare main coverage options are:

- Traditional Medicare (Typically more broadly accepted by providers)

- Comprised of Medicare Parts A and B

- Possibly paired with:

- Medicare Part D plan (prescription drug coverage) and

- A “Medigap” or “Medicare Supplement” plan which is designed to help cover some of the traditional out-of-pocket costs that apply under Medicare, including the Part A deductible and Part B coinsurance.

- A Medicare Advantage Plan (Structured more like a PPO or HMO that you may have had through an employer plan while actively working)

- Also known as a Medicare Part C plan

- May or may not be paired with prescription drug coverage

- Could have a lower premium cost vs. Traditional Medicare & Medigap options

- May cover additional benefits like hearing or vision, but may also:

- Restrict your choice of providers (through a network that may be subject to local providers)

- Feature cost containment measures (like prior authorizations or referral requirements)

One you decide which arrangement works best for you, you still have the choice of deciding which specific Medicare Advantage, Medigap, and/or prescription drug plan you want. Typically, your choice will be between plans with lower monthly premiums that feature higher out-of -pocket costs when services are provided and plans with higher monthly premiums and lower out-of-pocket costs for services. When you choose your plan for the coming year, it’s recommended you consider the total premium, the potential medical and prescription drug services you may incur in the coming year, and whether your current medical providers participate in your desired plan’s network (if applicable).

Additional Resources

Whether Part A, B and C sound more like complicated furniture assembly directions or you feel comfortable with your options, Medicare resources are available at both the federal and state level to help you evaluate your options and navigate the enrollment process.

The Centers for Medicare & Medicaid Services (CMS) (https://www.cms.gov/) have a number of online resources for individuals, in addition to creating an annual “Medicare & You” handbook that is sent to Medicare households each year in late September. This handbook provides the high-level basics on Medicare options, enrollment periods, and information on how an individual becomes enrolled in Medicare. The guide also has detailed and up-to-date information on all the services that are covered by Medicare. (For instance, acupuncture became an allowed service in early 2020!)

In Pennsylvania, the Department of Aging features a robust Medicare website with access to free counselors who are available to help answer questions and provide objective information to health plans available to you. These counselors can be a valuable complimentary resource to help you:

- Understand the current Medicare plan you have in place

- Learn how your current plan compares different options available to you

- If you need assistance in processing a Medicare appeal.

If you are not a Pennsylvania resident, check your home state’s online resources to see what tools may be available to you.

As open enrollment season approaches, remember that a more informed choice on your Medicare coverage can help you manage healthcare costs and potentially bring a little more peace of mind with respect to your health as you begin a new year.

Catherine Azeles, CFP®, RICP®, an Investment Consultant at Conrad Siegel has been named the winner of Central PA Leukemia and Lymphoma Society’s (LLS) 2021 Woman of the Year. During a 10 week campaign this spring, Catherine raised over $77,000 to help fund therapies that save the lives of blood cancer patients every day and research which has led to developments in all cancer treatments.

“Congratulations to our winners, and to all of our candidates and campaign team members who participated in this year’s Man & Woman of the Year campaign,” said Lauren Iannucci, LLS Regional Executive Director. “These exceptional volunteers are all passionate and determined individuals, and leaders in their communities. Together, we are getting closer to LLS’s goal of world without blood cancer.”

LLS is the world’s leading non-profit voluntary health organization dedicated to finding cures for blood cancers and ensuring that patients have access to lifesaving treatments. The funds raised through LLS’s Man & Woman of the Year are used for:

- Research to advance targeted therapies and immunotherapies that are saving thousands of lives;

- Blood cancer information, education and support for patients;

- Policies that ensure patients have access to blood cancer treatments

At Conrad Siegel, Azeles is committed to helping families achieve their financial dreams. She works holistically with each one of her clients to explore their current financial situation and, craft the process for them to reach their goals.

Outside of her work at Conrad Siegel and being a mother, Azeles stays involved and helps educate her community through her involvement with the United Way’s Women’s Leadership Network and Investment Committee for The Foundation for Enhancing Communities (TFEC). She has also been featured in the media on ABC27, FOX43, WITF, and Forbes.

This is a question we often hear people ask – is now a good time to invest? Sometimes it is asked after the market has had a good run and is sitting at an all-time high. Other times it comes up when the market has been through a significant downturn.

So, what’s the answer? If you are truly a long-term investor, it’s always a good time to invest. Should the market be higher in 10 years from now? Yes. What about 20 years from now? Absolutely. Let’s look at some data points that should be meaningful in understanding if now is a good time to invest.

When the stock market hits an all-time high, the media loves to talk about it and investors often feel like they will not have strong gains moving forward. However, the data says otherwise. The historical data indicates that over 1, 3 and 5 year periods after the market hits an all time high, the average subsequent performance is actually quite good. These are annualized (i.e. – average annual) returns and are quite strong.

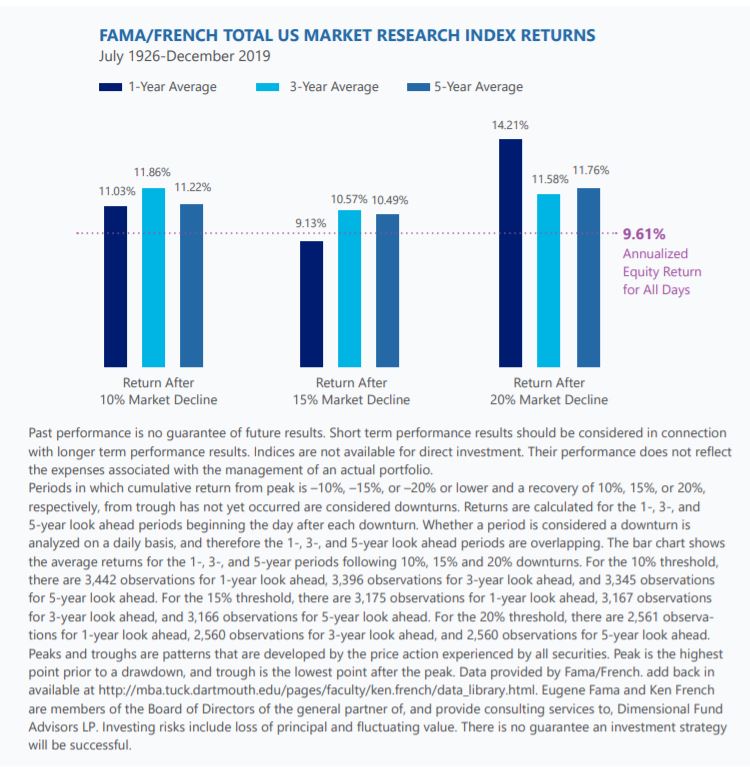

Let’s also look at the average performance of the stock market after the market endures losses of 10, 15 or 20%. This study shows that US stocks have generally delivered strong returns over the following 1, 3 and 5 year time periods following a steep decline. In nearly all cases, the subsequent performance is above the long-term average annual return of equities.

So what have we learned? If currently invested, sticking with your plan helps put you in the best position to capture the recovery. If sitting in cash and waiting for the best time to invest, often we end up waiting well past the optimal point in an effort to capture perfect timing. Data suggests it’s impossible to time the market, so investing either via a lump-sum or gradual dollar cost averaging approach is often the most prudent strategy when investing a cash position.

There is a lot of talk about inflation these days. Indeed, there are many economists and policymakers who are on national TV or writing articles online about how they are forecasting higher inflation through the rest of the year. They argue that with interest rates being so low, so much Federal stimulus money flowing through the economy, and the economy emerging from a pandemic, prices will rise faster than many people expect. However, let’s take a step back and review what exactly inflation is, how it affects the economy, and what can be done about it.

Inflation is the general rise in prices in an economy. Its presence typically means that an economy is growing, especially when inflation is accompanied by rising wage growth. The 2% rise in milk prices when you go to the grocery store won’t matter as much to you if your wages have kept up. Supply and demand for goods and services are in relatively good equilibrium. An increase in inflation doesn’t mean that prices for all goods and services are rising in unison, just that a “basket” of these have shown price increases overall.

It makes sense then that the amount and rate of change of inflation matters. When inflation is low and stable, wages have an easier time keeping up, and consumers can make adjustments to their budgets relatively easily to combat rising prices. The FED has come out in the last year saying that they are targeting an “average” of 2% inflation, meaning that continued they are okay if inflation runs higher for a time, just so the average is about 2%. This rate of inflation, in their eyes, means that the economy is in equilibrium, with prices rising just enough so that the economy can grow at a sustainable rate. However, this has been quite the difficult task over the last ten years:

As mentioned, rising inflation numbers are typically synonymous with a growing economy (if it’s not, it’s called stagflation, where there is inflation but no growth in the economy), and therefore are also synonymous with rising interest rates, mostly in the long-term end of the curve. When inflation expectations rise, longer-term yields typically rise along with them. This can play havoc in the bond market. Rising rates and inflation mean that the purchasing power of each coupon (interest) payment an investor receives has declined.

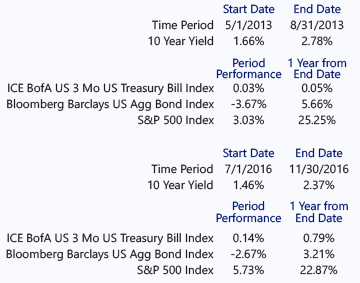

In addition, those with longer duration bonds in their portfolios will see larger price declines as rates rise. This is typically a short-term phenomenon though. Looking back over the last ten years, there have been two times when rates rose dramatically over a short period. Both times, the Barclays U.S. Aggregate Bond Index, a benchmark that tracks intermediate-term bonds, bounced back in the year after the dramatic rise ended:

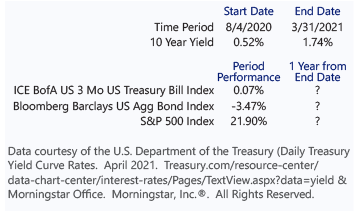

This time around, the 10 year yield bottomed on August 4, 2020. Since then, the Barclays U.S. Aggregate Bond Index is down 3.47%.

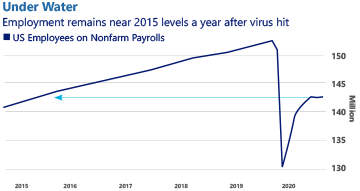

With both inflation and inflation expectations rising, then, why is the FED sticking to the original script and forecasting no rate increases until 2023? The FED has a dual mandate of price stability and maximum sustainable employment. As mentioned, they came out last year with an updated inflation goal of an “average” of 2%. This means that they will allow inflation to run hot (over 2%) for a time before considering raising their benchmark rate. While current inflation is approaching this 2% target, they still are not worried. Why? There is still considerable slack in the jobs market despite the unemployment rate falling by over half since the pandemic started: The economy has yet to regain over 9 million jobs lost from the pandemic.

The FED sees this and thinks that with this much slack in the jobs market, price pressures due from rising demand may be transitory due to short-term stimulus from the Government. Inflation can be a good thing, especially when it’s not volatile and it’s expected. However, when inflation runs too high, or when there are unexpected shocks, that can cause mayhem in markets. The FED’s job is to manage this inflation risk, taking into account many different factors, hopefully smoothing out any volatility that could arise.

There is certainly some pain being felt in portions of the markets with rates rising. We have already seen bond funds posting negative returns due to the increase in rates and the low starting point. However, it is also not desirable for investors to earn close to a 1% nominal yield on their bonds in the long-run. Certain parts of the equity markets that increased dramatically on the backdrop of low interest rates have already started to see a pull back with rates moving north. However, this could be viewed as a healthy correction and other parts of the markets that did not have the same large rally in 2020 are showing some stronger performance. We don’t yet know the length and magnitude of this current rising rate environment, and inflation certainly can be problematic. However, it is important to know that higher rates and inflation expectations can be a good thing, especially when accompanied by strong economic growth, which is what we are seeing now as we emerge from this pandemic. A historic recession and unprecedented fiscal/monetary response is likely to result in a recovery that has its stressful and uncertain moments. But as always, we believe it is important to keep focused on a strategy that matches your time

horizon.